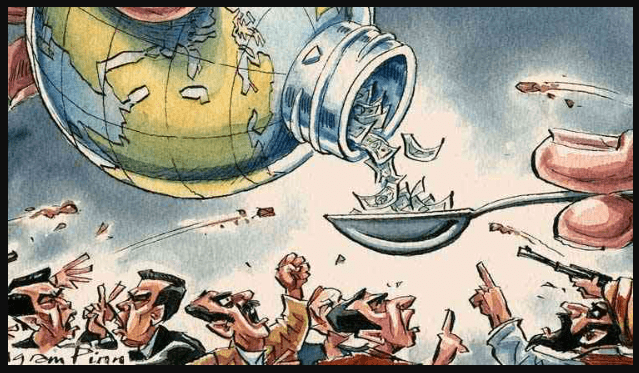

Globalization makes poor more poor and rich more rich

How does capitalist system make rich richer and poor poorer?

This is a very timely and good question. In recent last 10 years, there seems to be something wrong with capitalism which results in the new generation to remain poor despite working hard. While I am not sure if the rich get richer, the poor seems to be poorer in the current system.

The basic appeal of capitalism is that if you work hard, you can be successful economically. This is the basis of the American Dream which allows the younger generation without much accumulated wealth to succeed equally versus the older generation. Unfortunately, this has not worked out for the current younger generation worldwide who started working between 2008 to 2013.

Initially, the generation that started to work in this period faced difficulties finding secure jobs because the economy has not recovered. Furthermore, starting wages were not as attractive as usual. By 2008 to 2009, there were some recovery in the system but the wages did not increase significantly. From 2008 to 2015, wages stagnated in many developed countries which is a very long period of time. So this generation did not enjoy significant increase in income even though they work very hard during the mild economic recovery. On this basis alone, capitalism has not work for them. But things may just get worst.

At the start of their career in 2008, this generation do not have money to buy houses due to lack of savings. Low wages means it takes longer to save up for a house. Five years later, in 2012 to 2013, housing prices are up again due to low interest rates. So these workers have to borrow significant amounts of money to buy houses at a higher price. By the time it is 2016 and 2017, the stock market is trading at sky high valuations similar to year 2000 before the dot com crash. This is also the time when these workers have just accumulated some savings after spending on housing. So they start to invest in the stock market just when things are so expensive.

A common theme among this generation is that working is not going to generate enough income to retire, so you have to invest in something because bank savings interest rates are so low and wages are also low. Many decided to roll the dice and invest in risky investments like Bitcoin to try to get rich. The worst part is that many decided to borrow significant amounts of money to buy houses because they believe that interest rates are going to be low and house prices are going to go up for many more years to come.

Unfortunately, interest rates have begin to rise in 2018 and this is bad on two fronts. Firstly, this will likely cause asset prices to drop significantly and this generation will suffer losses if the houses they bought drop a lot in price. Secondly, they may have to pay off their debt which they incurred to buy the houses in the first place. This will further reduce the income that they have left for spending. This maybe particularly pronounced at major city centers like Hong Kong, Toronto, Sydney, New York, and London. If asset prices drop, this generation will lose their last hope for success in capitalism.

Imagine a working class worldwide with not enough wages, not enough bank interest on savings who just lost their precious savings in a crash. Further, they have to pay back their debts. What would happen? More likely than not they will have to delay starting families, and work longer hours.

In short, the current system has favour people with more capital at the beginning of year 2008 to 2009 because the only game in town was asset price appreciation. In general, wages didn’t work for most people.

Arguably, everybody loses money if there is another financial crisis. In fact, people with more capital loses more money. The main difference is leverage or debt levels. Although people with more capital loses more money, they still can survive if they have sufficient capital left without any debt to pay off. For people who don’t have money to begin and borrowed significant amounts of money, a crash will wipe them out. So technically, higher debt levels and stagnating wages over time among the poorer maybe the reason why the poor get poorer. In particular, when you have a whole generation of working class that had not much choice but to borrow money, this problem becomes more concentrated in one cohort of workers. But it does not mean the rich get richer because they will lost money too.

More Information:

Introduction: Globalization, the interconnectedness of economies and societies worldwide, has been a defining feature of the contemporary world. While it has ushered in unprecedented economic growth and cultural exchange, it has also been a double-edged sword, exacerbating existing socioeconomic inequalities. The rich have become richer, and the poor, unfortunately, more impoverished, as globalization's benefits and drawbacks are distributed unevenly. The Rich Get Richer: One of the primary consequences of globalization is the amplification of wealth accumulation among the affluent. Transnational corporations and globalized financial systems allow the wealthy to exploit favorable conditions in various countries, often at the expense of the less privileged. Multinational corporations can take advantage of lax regulations and low labor costs, further concentrating wealth in the hands of a select few. Moreover, the interconnected global economy has enabled the affluent to diversify their investments across borders, mitigating risks and maximizing returns. This ability to exploit global financial systems has led to an unprecedented accumulation of wealth, creating a global elite that transcends national boundaries. The Poor Get Poorer: Conversely, the impact of globalization on the impoverished has been less favorable. While economic growth has been a hallmark of globalization, it has not translated into equitable distribution of wealth. Developing nations often find themselves on the losing end of global trade, facing unfair terms and conditions that perpetuate their dependence on more economically powerful nations. Global competition can also lead to job displacement in less developed regions, as industries move to countries with lower production costs. This not only contributes to unemployment but also fosters a cycle of poverty, as these communities struggle to adapt to the rapidly changing economic landscape. Addressing the Imbalance: To mitigate the negative impacts of globalization, a concerted effort is required on both national and international levels. Developing nations must work collectively to negotiate fair trade agreements that prioritize sustainable development and social justice. Additionally, there is a need for global financial reforms that promote transparency, accountability, and the equitable distribution of resources. Conclusion: Globalization has undoubtedly reshaped the world, bringing about economic prosperity and cultural exchange. However, it has also perpetuated and intensified existing socioeconomic disparities. To ensure that the benefits of globalization are shared more equitably, there must be a commitment to addressing the root causes of inequality and fostering a global economic system that uplifts the poor while preventing the unchecked accumulation of wealth among the rich. Only through such concerted efforts can we harness the positive aspects of globalization while mitigating its adverse effects on the world's most vulnerable populations.